How Can I Save On Taxes Throughout Retirement?

We will articulate how you can save on taxes during retirement and reframe the goal from minimizing taxes owed annually to lowering our lifetime effective tax rate. By paying taxes intentionally when rates are the lowest, you save in total inflation-adjusted taxes paid over your life.

What are my options for increasing taxable income?

Map out your marginal effective rate over time, seeking to reduce the peaks and increase the valleys. The idea is that you want to reduce taxable income when rates are higher while increasing taxable income at lower rates. This frequently looks like Roth conversions to pull income forward.

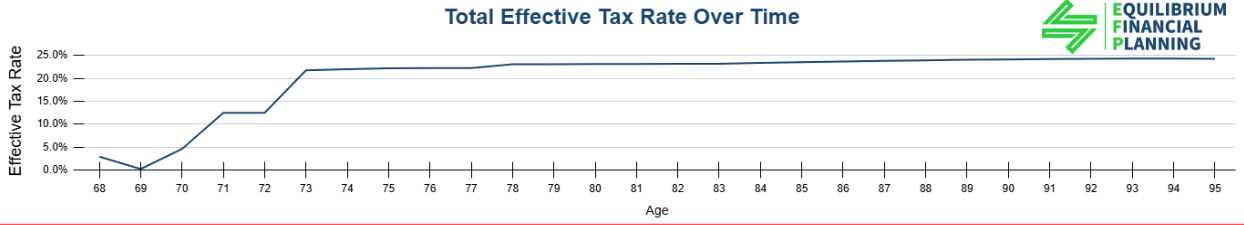

If your plot of effective tax rates over time resembles the one above, which is very common for retirees, you should consider pulling taxable income forward between ages 68 and 72 before RMDs kick in at 73. Doing so allows you to pay taxes at rates lower than the 22-24.3% range (assuming no expiration of TCJA), since you will fill up the 0%, 10%, 12%, and 22% brackets. Note that you should be mindful of the impact of Medicare IRMAA (Income Related Monthly Adjustment Amount) premium adjustments as well as NIIT (Net Investment Income Tax) implications. The presence of IRMAA and NIIT is why we distinguish between minimizing your marginal tax rate and marginal effective tax rate, which is your total tax liability divided by taxable income. Essentially, your effective tax rate in this sense considers the impacts of IRMAA and NIIT, among other gained or lost credits and deductions, and the graphs shown account for these impacts.

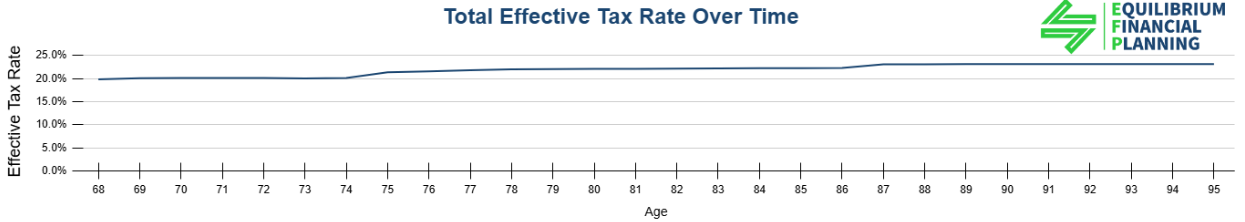

By pulling income forward through a Roth conversion ladder from years 68-72 as described above, the graph should look similar to the one below.

Not only would you now have less inflation-adjusted income taxable at higher effective rates in the future, but your maximum effective tax rate is decreased from 24.3% to 23.1%. The nominal savings from implementing this strategy is $210,251. The magnitude of the savings is very scenario specific and dependent on assumptions used, so the important takeaway here is that the benefit is significant but depends greatly on your individual circumstances.

What if I need to decrease my taxable income?

If you are charitably inclined, Donor Advised Funds (DAFs) allow you to contribute a large sum to your DAF account and distribute it to your preferred charities over time. This is beneficial because you can itemize your deductions in the year of the substantial gift while enjoying the standard deduction in subsequent years. Your charity will see no difference in cash inflows since your DAF can give annually at your chosen rates.

For example, assume you typically give $10,000 per year to your favorite charity, however, your total itemized deductions do not exceed the standard deduction of $14,600 for single filers in 2024. This means that your $10k/year donations have no impact on your taxes since your standard deduction of $14,600 exceeds your itemized deductions, and you can only take the greater of the standard deduction or itemized deductions. If you know that you plan to give $10k/year for the next 5 years, you might consider establishing a DAF for $50,000 in tax year 2024. This enables you to itemize deductions for $50k in 2024 before taking the standard deduction in years 2025-2028. Your tax savings here, assuming you are in the 32% tax bracket is $11,328 [(50,000-14,600)*.32]. This reflects the itemized deduction we took from contributing to our DAF less the standard deduction that we would have taken otherwise multiplied by our marginal tax rate. Additionally, you can contribute appreciated securities in taxable accounts to your DAF. This avoids paying capital gains tax on appreciated investments, and your DAF receives the full market value of the assets.

Is there a better way to reduce taxable income?

Qualified Charitable Distributions (QCDs) are available to those over 70.5 and represent a superior option for those with philanthropic intentions. QCDs represent an “above the line” deduction which means instead of reducing your taxable income, they reduce your AGI (Adjusted Gross Income) and MAGI (Modified Adjusted Gross Income). This is relevant because many credits and premium adjustments, including IRMAA, are calculated based on AGI or MAGI. Additionally, QCDs satisfy your RMD requirements for the amount given.

What is the bottom line?

Navigating tax strategies in retirement requires a comprehensive and forward-thinking approach. By focusing on your lifetime effective tax rate rather than annual tax minimization, you can achieve significant savings over time. The key is to be intentional and strategic, taking advantage of opportunities to manage your taxable income effectively.

Remember, the goal is to smooth out your tax liability over your retirement years, filling up lower tax brackets when possible and avoiding spikes in taxable income that push you into higher brackets. Roth conversions, Donor Advised Funds, and Qualified Charitable Distributions are powerful tools to achieve this end.

It is crucial to recognize that every retiree's situation is unique. Factors such as your income sources, asset mix, charitable inclinations, and overall financial goals will all play a role in determining the most effective tax strategy for you. Additionally, tax laws and regulations can change, potentially altering the effectiveness of certain strategies.

Given the complexity of these decisions and their long-term implications, it is often beneficial to work with a qualified financial planner or tax professional. They can help you model different scenarios, stay updated on tax law changes, and tailor strategies to your specific circumstances.

Ultimately, by taking a thoughtful, long-term approach to tax planning in retirement, you can keep more of your hard-earned money working for you, enhancing your financial security and allowing you to focus on enjoying your retirement years.